Structure and Overview of Indian Budget

Budget Meaning:

The budget is the overall financial

framework that serves as the performance benchmark for all financial decision.

Article 112 of the Constitution of

India calls it – ‘Annual Financial Statement’

·

Statement

of Revenue

·

Statement

of Expenditure

·

Overall

Statement

Importance of Budget:

• Intension of the Government

• Priority of the Government

• Policies of the Government

• Allocation of the Financial

Resources

• Planned approach to

Government’s activities.

• Integrated approach to fiscal

operations

• Influences on the functioning

of the economy

• Index of Government’s

functioning

• Public accountability

Origin of word:

Budget word is adopted from

Middle English Word ‘Bowgett’ which came from Middle French word ‘BOUGETTE’ –

which means a “Leather Bag”.

History of Budget in India:

The founder of

Budget system in India is James Wilson who presented a Budget on 18th Feb.1860

as a member of council of the Viceroy Lord Canning. The First Budget of Independent India was

presented by R. K. Shanmukham Chetty on 26th Nov. 1947.

Who Causes the Budget:

The President of India causes the

budget to be laid before the Lok Sabha.

Department of Ministry of Finance:

The Ministry

comprises of the five Departments namely:

· Department

of Economic Affairs

· Department

of Revenue

· Department

of Expenditure

· Department

of Financial Services

· DIPAM

(Department of Investment and Public Asset Management)

How is the Budget Made in India:

·

The

Budget Division of the Department of Economics Affairs of the Ministry of Finance

is the nodal body responsible for the

preparation & presentation of the Budget.

·

Department

of Economics Affairs of the Ministry of Finance publishes annual Economic

Survey.

·

For

preparing the estimates for the next year, the budget division issues the

circular to –

•

Union Ministries

•

Union Territories

•

Autonomous Bodies & Departments

•

Defence Forces

·

Budget

is made through a consultative process involving –

•

Ministry of Finance

•

NITI Aayog

•

Spending Ministries

Finance

Ministry issues guidelines to spending, based on which ministries present their

demands

Pre-Budget Meetings:

• After receiving the demands, extensive

consultations are held between Union Ministries and Department of Expenditure.

• At the same time pre-budget

consultations are held with different stakeholders viz. State representatives,

Agriculturists, Industrialists, Businessmen, Economists, Civil Society Groups &

Trade Unions to take their views.

• Once the pre-budget meetings are over,

the final call on the tax proposal is taken by the Finance Minister.

• Proposals are discussed with the Prime

minister before the Budget is frozen.

• Finance Ministry collects information

about receipts and expenditure from various departments to prepare the revised estimates

for the budget.

Budget Printing:

• The Finance Minister and other

official participate in ‘Halwa Ceremony’ which marks the starting of the

process of Printing Document of the Budget.

•The officials and support staff

directly involved in the budget making and printing process are required to

stay in the ministry and remain cut-off from their families until the presentation

of the Budget.

Budget Consists of following details:

·

Actual

of the previous year (Actual)

·

Budget

estimate of current year (B.E.)

·

Revised

estimate of current year (R.E.)

·

Proposed

Budget estimate of next year (B.E.)

Presentation of Budget:

• Finance

Minister goes to meet President to seek permission for Budget Presentation.

• The Finance

Minister briefs the cabinet on budget proposals through the ‘summary for the cabinet’

just 10 minutes before presenting the budget in the Parliament.

Budget Consists of two parts:

·

Part

A – Speech

·

Part

B – Amendments in Taxes

Three major changes in budget 2017-18:

·

Budget Presentation Day advanced from

end-February to 1st February.

·

Elimination of the distinction of Plan and

Non-Plan expenditure in the Budget.

·

Railways

Budget merged with General Budget.

Railway Budget briefing:

• 1920 : William

Mitchell Acworth ; Chairman, Committee of East Indian Railways; recommended about consolidation and

nationalization of the Indian Railways.

• Acworth

Committee recommendations were finally passed on 20 September 1924 as the

Separation Convention.

• The Railway

finances of India were separated from the general government finances in 1924.

• Committee of

Restructuring of Indian Railways, Chairman Dr. Bibek Deboray (Sept. 2014 – June

2015); Recommended Railway budget should be phased out, and general budget

support to railways to be mentioned as a paragraphs in the budget.

The budget is divided into two

parts 1- Revenue Account and 2- Capital Account.

Now we will see brief

introduction of above these two accounts…

Revenue Account:

Revenue Account

covers the current receipts and running expenditure. It includes the variations

in money balances created or owned by the Government.

Revenue Receipts include proceeds of taxes and

other duties levied by the Government, interest & dividends on investment

made by the Govt., & Fees and other receipts for services rendered by the

Govt.

Revenue receipts increase treasury’s usable funds

without increasing debt obligations.

Revenue Expenditure is meant for normal

running of Govt. departments and various services, interest charges on debt

incurred by the Govt. and subsidies, grants given by the Govt. etc.

Broadly speaking, the expenditure that does not result in

creation of assets is treated as revenue expenditure. Revenue

expenditure decrease treasury’s usable funds without decreasing debt

obligations.

Capital Account:

The Capital

account covers the creation

and disposal of assets and liabilities. It includes the items of

receipts & disbursements of those items –

·

Which

do not belong to the Govt. (e.g. loans, deposits etc.)

·

Which

lead to variations in physical assets of the Govt. (e.g. their acquisition,

creation, disposal etc.)

·

Which

lead to variations in financial claims & liabilities of the Govt.

The main items

of capital receipts of loans raised by the Govt. from the public, borrowings

from the RBI, loans from abroad, recovery of loans & also proceeds from the

disinvestment of Govt. equity in public enterprises.

Capital Expenditure

includes the payments for acquisition of assets like land, building, machinery,

equipment etc., and also investment in shares & loans given by the Govt.

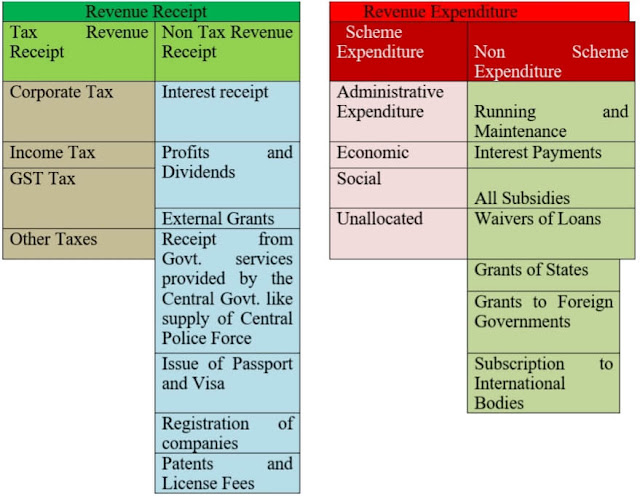

Revenue Account Chart:-

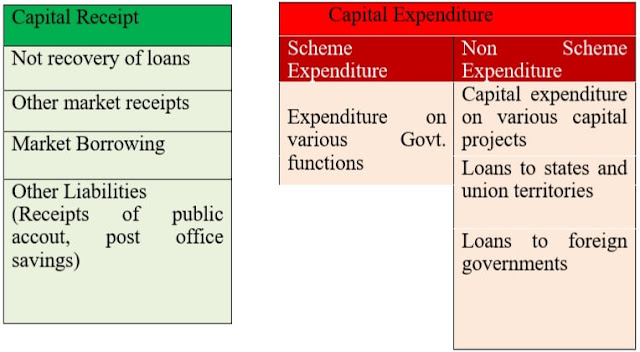

Capital Account Chart:-

Plan Vs. Non-Plan Expenditure:

·

11th

Finance Commission (2000-2005) headed by Dr. A. M. Khusro had recommended to

examine the issue for eliminating the distinction between plan and non-plan

expenditure.

·

High

level Expert Committee on Efficient Management of Public Expenditure headed by

Dr. C. Rangarajan had recommended a fundamental shift in the approach of public

expenditure by removing the Plan & Non-plan distinction and budgeting

linked to output & outcomes.

·

Union

Budget 2016-17 announced that the Plan & Non-Plan classification to be

eliminated from 2017-18.

·

Now

after abolition of Planning Commission & Setting up of NITI Aayog the term

Plan expenditure has lost its relevance. Therefore after the end of the 12th Five

Year Plan in 2012-17, the Plan and Non plan

distinction has been removed from 2017-18.

Thank You 😊!!!

Note:

- Please give your feedback in the comment box. Your comments mean a lot to us, and can clear your queries.

- You can suggest topics which you need or want to read. We will first try to write the article on the topic suggested by you.

- We need your support so please subscribe the blog and share to at least 5 persons.

Post a Comment

Post a Comment